Wealth & Investing

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. You’re not going to get rich renting out your time. You must own equity - a piece of a business - to gain your financial freedom. A leveraged worker can out-produce a non-leveraged worker by a factor of 1,000 or 10,000. With a leveraged worker, judgment is far more important than how much time they put in or how hard they work. - Naval

Learnings

- Invest automatically and monthly in a diverse range of asset classes, focused on ETF index funds

- Focus on increasing your earnings and minimizing spending, rather than increasing spending in proportion to increases in earnings

- While analyzing individual companies or finding market inefficiences broadly can be enjoyable, it is unlikely to lead to outperforming the market as a whole for the majority of people

- Invest in yourself, and create a business

How To Be Successful by Sam Altman

- Compound yourself

- Have almost too much self-belief

- Learn to think independently

- Get good at “sales”

- Make it easy to take risks

- Focus

- Work hard

- Be bold

- Be willful

- Be hard to compete with

- Build a network

- You get rich by owning [productive assets]

- Be internally driven

Luck is the sum of the expected values of all your asymmetrical actions in life (high potential upside, low downside)

The Index Mind Set

“Indexing provides a safety net against failure, so it can be hard to reject. But you can start small. Every index has underlying assets that are below average, so you can start by identifying which components are weighing it down. This could be empty relationships, weak investments, or unfulfilling hobbies. Over time, narrow the index into a handful of bets, each of which you can staunchly defend.

Abandoning the index mindset may be more valuable than ever. When everyone is indexing, their collective trance distorts reality.

The index mindset is sedative, a substitute for conviction. And conviction pays off, as Howard Marks succinctly put it: “if you wait at a bus stop long enough, you’re sure to catch your bus, while if you keep wandering all over the bus route, you may miss them all.”

How To Be Successful

— Sam Altman (@sama) January 6, 2020

(At Your Career, Twitter Edition)

Links

- Understanding How Wealth Is Created

- Productivity by Sam Altman

- Does It Pay To Do More Research?

- Wealth Tips for Founders by Daniel Gross

- Soros: General Theory of Reflexivity

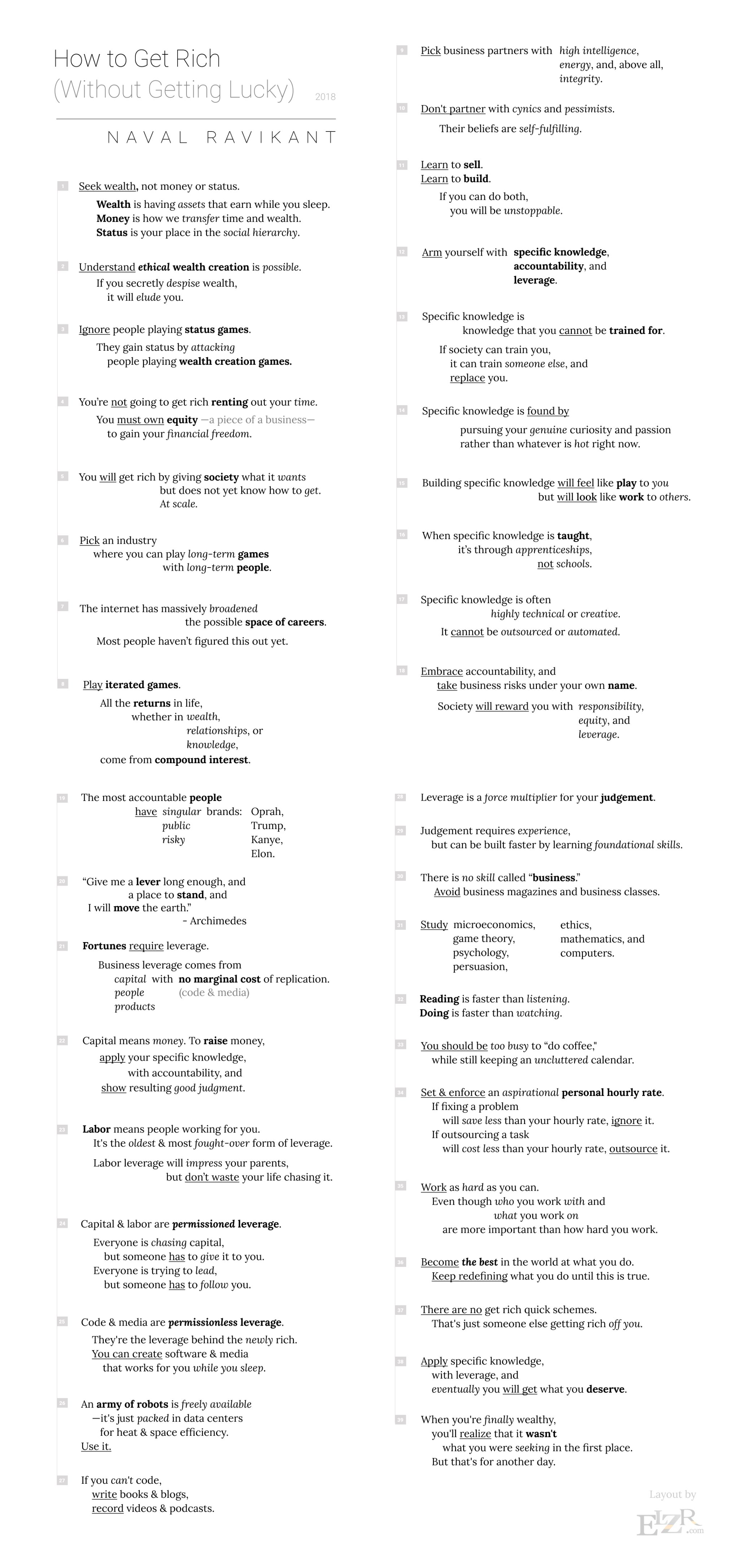

How to Get Rich (without getting lucky):

— Naval (@naval) May 31, 2018

Investing Books

- Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger,

- The Almanack of Naval Ravikant: A Guide to Wealth and Happiness

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market

- 100 Baggers: Stocks that Return 100-to-1 and How to Find Them by Mayer

- Excess Returns: A comparative study of the methods of the world’s greatest investors by Vanhaverbeker

- Common Stocks and Uncommon Profits and Other Writings

- Seeking Wisdom: From Darwin to Munger

- The Intelligent Investor: The Definitive Book on Value Investing (classic, read critically, partially outdated)

Safe Haven: Investing for Financial Storms by Spitznagel (great book on the theory of tail hedging, but a bit thin on executing those ideas)

- The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by Thorndike (outstanding book about CEOs who excelled at capital allocation.)

Best investing attitude is contrarian, patient, informed optimism. As Mike Maples says, “non-consensus and right.”

Angel Investing

- How To Invest In Startups (highly recommended)

“to do well as an investor, you need to do three things: get access to good investment opportunities, make good decisions about what to invest in, and get the companies you want to invest in to choose you as an investor”

- Thoughts on Investing

- 11 angel investing lessons

- How to Angel Invest, Part 1

- How to be an angel investor, Part 2

- How to be an angel investor, Part 3

- 7 angel investing tips in 7 minutes

- Startup Investing Trends

- How to Be an Angel Investor

- The Hacker’s Guide to Investors

- A financial argument for deep tech by Ian Rountree

- The Unified Theory of Value & Tech Investing (or, How Cantos Invests)

Startup Investor School by Ycombinator

- “Free 4-day course designed to educate early stage investors interested in investing in startups. We’ll cover the fundamentals of investing, from investing instruments to legal and accounting basics to evaluating startups and managing deal flow. Our hope is that more people, from a wide range of backgrounds will consider investing in startups and that those who do will be better at it.”

see the full playlist of 16 videos

Great videos about investing, economics and more

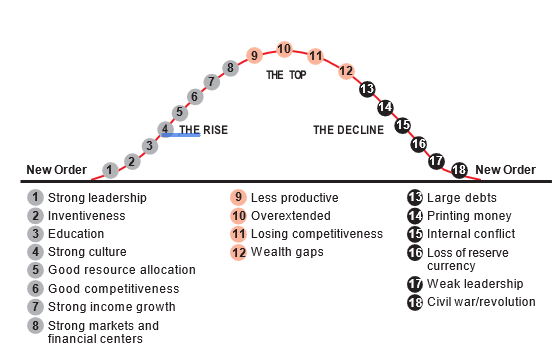

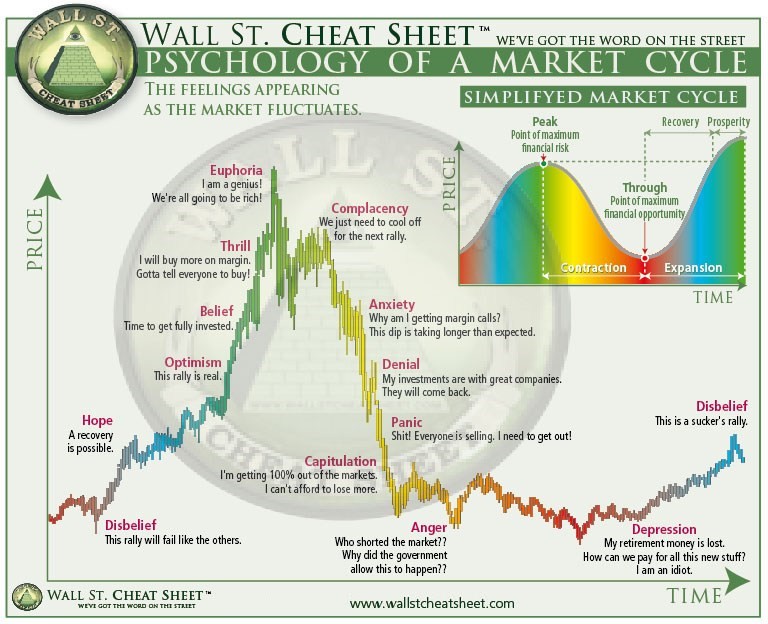

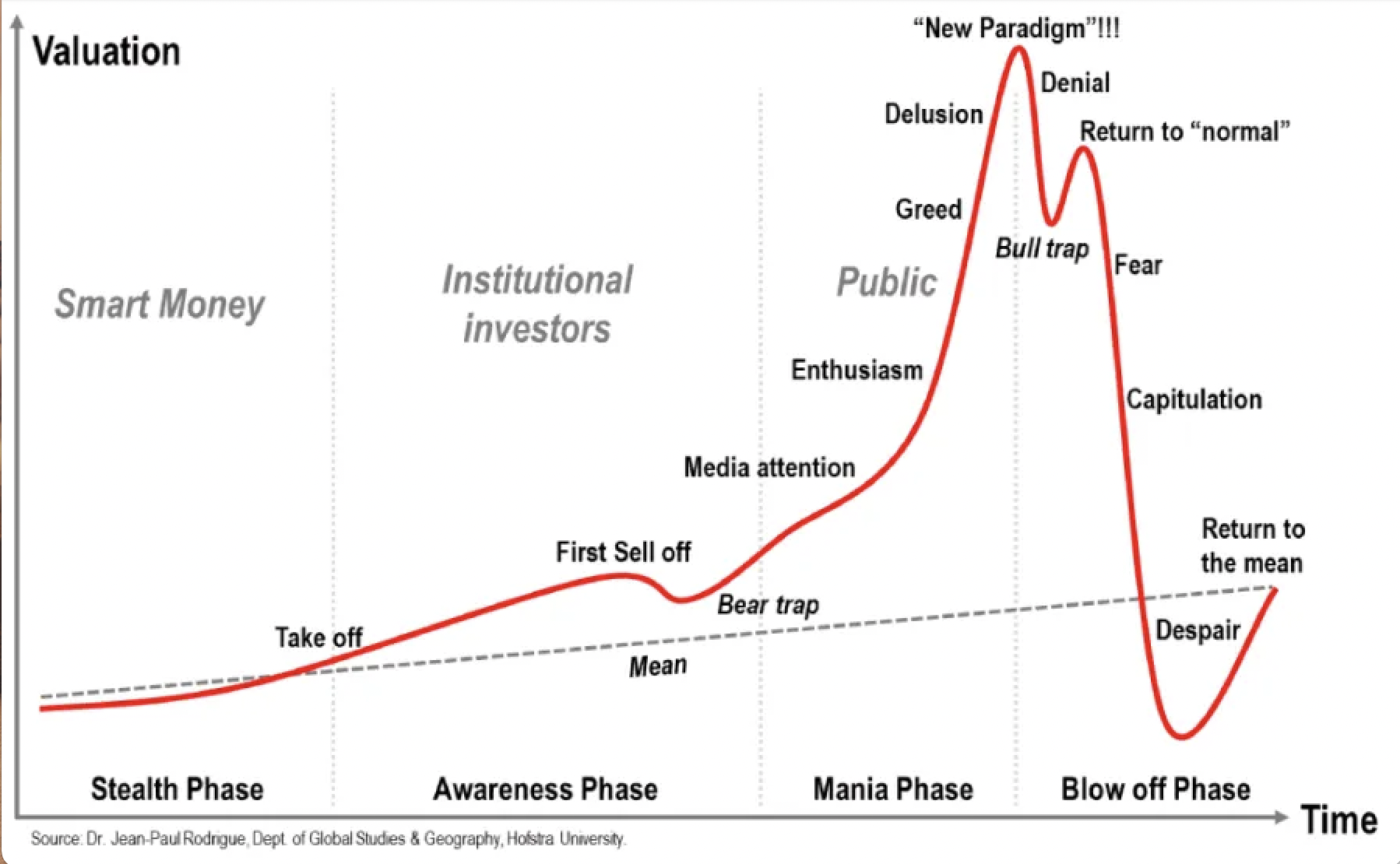

Timeless patterns and market cycles

Disclaimer: Not financial advice